WHAT IS A BUSINESS BUDGET ?

A business budget is the numerical translation of your strategy over a defined period (typically a year).

It’s a forecast plan that sets your revenue targets, expected expenses, investments, and projected outcomes.

It shows you:

- The direction to take (your sales, profitability, and investment goals),

- The necessary resources (cash flow, teams, equipment),

- The variances to monitor (cost fluctuations, sales changes),

- The adjustments to make (resource reallocation, prioritisation of actions).

A reasonable budget is not a rigid tool. It doesn’t prevent you from changing course.

It’s an evolving guide that allows you to manage your business with agility, discipline, and foresight.

Does your business need a budget?

Without a solid budget, your financial decisions rely more on instinct than data.

With a structured budget, you steer your company while staying on track—even through uncertainty.

Concretely, a budget helps you:

- Set a clear goal for your organisation. Align all your teams around measurable, realistic financial targets.

- Anticipate your cash flow needs. Forecast your financial flows to avoid liquidity stress.

- Invest more wisely. Allocate your resources to the most profitable projects with complete insight.

- Monitor variances and make quick corrections. Compare actuals to forecasts and adjust in real time.

- Strengthen stakeholder confidence. Banks, investors, and partners trust companies that know where they’re headed—and how they’ll get there.

The absence of a budget—or a poorly managed one—has a real cost:

- Unexpected cash shortages

- Risky investment decisions

- Loss of profitability on misaligned activities

- Inability to respond to unforeseen events

How much is flying blind costing you today?

Probably much more than the effort of building a solid budget.

Our Budgeting Approach at WE DOO ACCOUNTING

We don’t do “theoretical budgeting.” We create living budgets, practical, actionable tools for daily business management.

🔄 Economic structure analysis

In-depth understanding of your fixed/variable costs, overheads, and profit margins per business line.

📅 Global and departmental budget planning

We build consolidated and detailed budgets tailored to your internal organisation by departments, products, or subsidiaries.

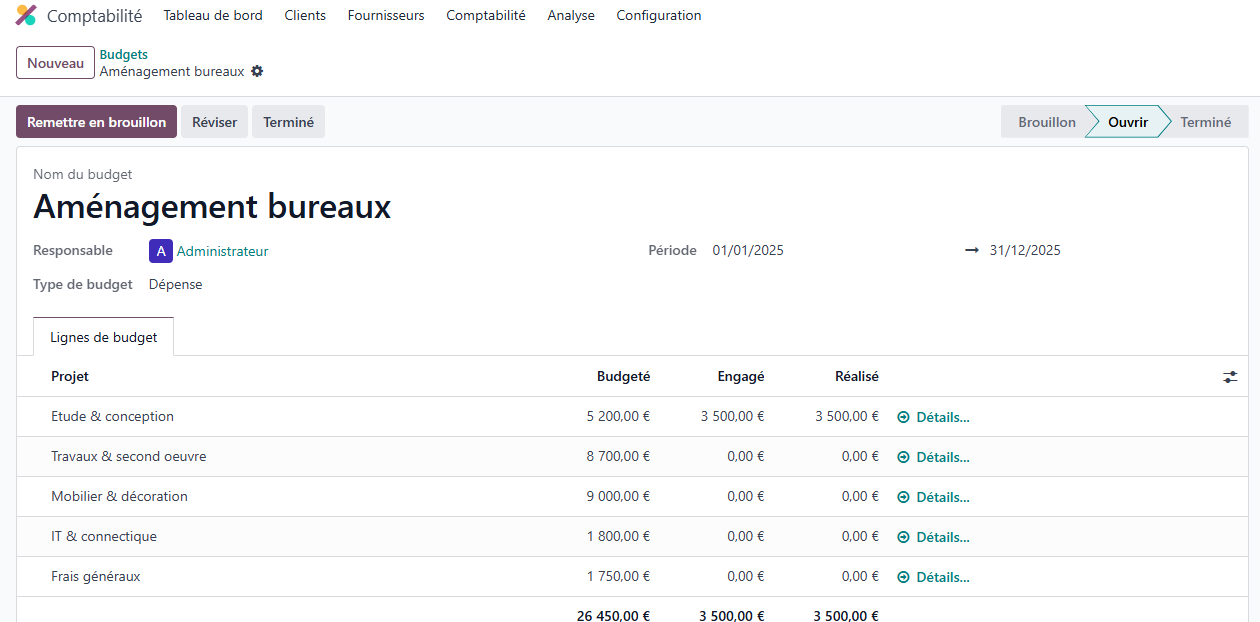

⚙️Odoo integration

Your forecasts are directly entered into your ERP to automate budget monitoring.

📐 Creation of accurate budget models

We help you build precise models and forecasts based on historical and real-time data in Odoo, continuously adjusting strategies as variances emerge.

📈 Budget simulation tools

Thanks to our expertise, we can test different growth or cost-optimisation scenarios, allowing your company to adapt forecasts to market conditions.

💻Real-time budget dashboards

Alerts on variances, root cause analysis, and corrective action planning.

👥Team training & support

So your budget is understood, used, and adjusted throughout the year.

DRIVE YOUR FUTURE WITH AN ODOO BUDGET

Odoo is the ideal platform to build and monitor your business budget.

- Direct integration: Your budget draws on your Odoo accounting data—no double entry.

- Financial and analytical planning: Depending on your needs, Odoo lets you build both analytical and financial budgets to track projects, products, or activities closely.

Want to learn more about analytical accounting ? Check out our offer

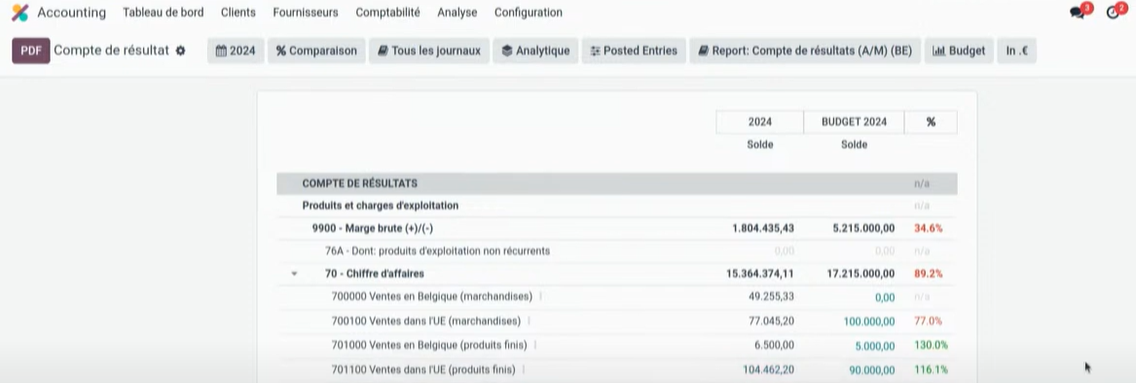

- Embed your financial budget into your P&L: Odoo allows you to display a "Budget" column next to actual results. Each line shows the planned amount, actual spending, and completion rate, which are updated automatically for the selected period.

- Customizable: Budget by product, service, project, or team with precision.

- Automatic updates thanks to Odoo's ERP power:

Budgeting can seem time-consuming, but follow-up is often the most challenging part. Not with Odoo. Its integrated modules (purchasing, sales, accounting) seamlessly synchronise actual expenses with your budget. - Real-time tracking: Instantly see gaps between forecasts and actuals through colour-coded alerts generated by Odoo.

- Rolling budget updates: No more frozen budgets—you can revise and adjust any time with Odoo.

- Save time: Automated flows, reusable templates, built-in alerts.

- Make faster, more reliable decisions: You manage your company based on solid, always up-to-date data.

Why Choose WE DOO ACCOUNTING?

Business management expertise

We support business leaders daily—from SMEs to international groups and mid-sized companies.

We understand your challenges with profitability, controlled growth, and cash flow stability.

Perfect command of Odoo

For smooth, automated integration

A pragmatic approach

A budget only has value if used daily, not if it’s forgotten in a shared folder.

Tailor-made work aligned with your reality.

We take into account your seasonality, sector risks, and strategic priorities.

A 360° vision of your company

We connect your operating budget with cash flow forecasts, investment plans, and strategic goals.

Proactive advice to optimise your resources and boost profitability.

What we do at WE DOO ACCOUNTING isn’t just about building a budget.

It’s about building your success.

Trust experts who think like entrepreneurs, not just accountants.